A One-Page Retirement Plan You Can Build in 15 Minutes

Most people think they need a thick, leather-bound retirement plan filled with charts, graphs, and strange words like “asset allocation” or “Monte Carlo simulation.”

They don’t.

What you really need is a plan you can understand in one glance, remember without digging through a drawer, and update in minutes.

That’s what a One-Page Retirement Plan does.

And you can build yours today in less time than it takes to drink your morning coffee.

Why keep it to one page?

The problem with most retirement plans is that they’re too complicated to use.

When something feels overwhelming, we avoid it. That’s why so many people have no plan at all. They don’t want to deal with a 50-page report.

A one-page plan keeps you focused on what actually matters:

When you want to retire

How much you’ll need

Where the money will come from

What you must do to get there

That’s it. No fluff, no filler.

Note: In this tutorial I'm using an online retirement calculator that generates a one-page retirement plan for me automatically. It makes it easier than writing it out by hand.

Click here to open the calculator in a new tab and follow along with the rest of the article below.

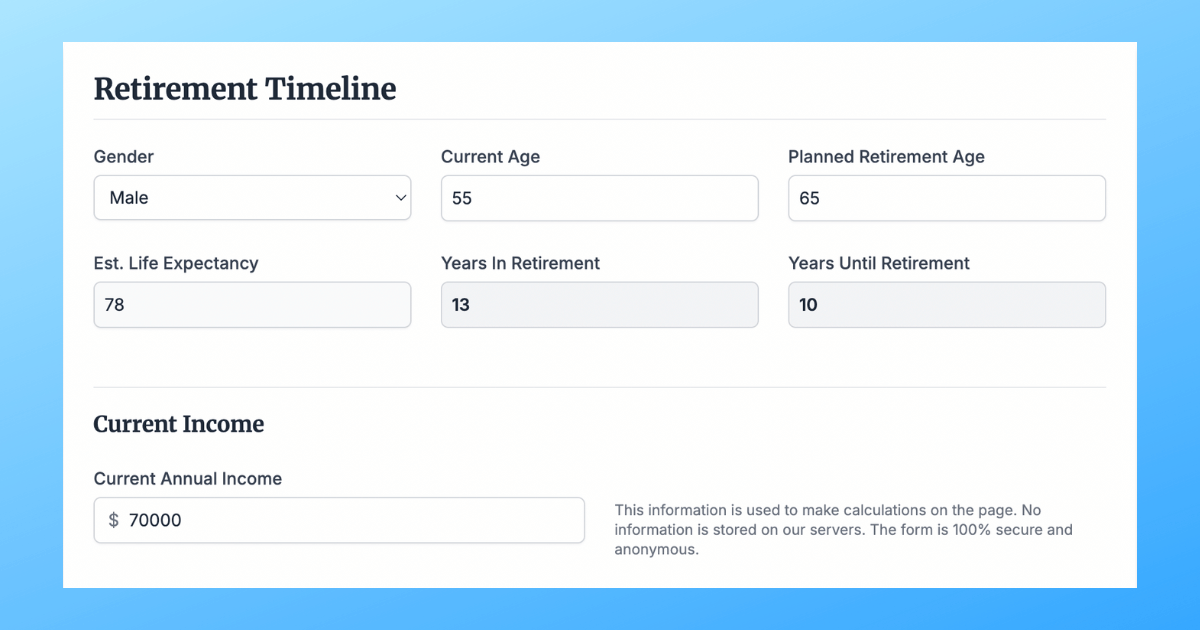

Step 1: Enter your age

First, enter your current age.

The calculator will use your age and gender to estimate your life expectancy based on the Social Security Administration actuarial tables.

This is cool because most life expectancy statistics are flawed for retirement planning.

In the United States, the average life expectancy at birth is 78.4 years, according to the CDC. But as you get older, your life expectancy actually increases.

For example, if you are a 60 year old man, you have a life expectancy of 21 more years. Then if you make it to 81, you have a life expectancy of 7 MORE years! And if you live to see 88, you have a life expectancy of almost 5 more years after that.

That's why retirement planning is tricky. Because you don't know exactly how long your retirement savings need to last.

So use this as a guideline, but just know that your retirement might last longer than you expect! Plan accordingly.

Step 2: Enter your planned retirement age

Next, enter the age you plan to retire at.

Deciding when to retire is actually the hardest part of the entire process. So read this section carefully.

Research shows that 58% of people retire WAY earlier than they planned.

And our estimates of when we think we will retire and when we actually retire, are way off.

Only 14% percent of workers say they plan to retire before 60. And 23% say they plan to work until 70.

But in reality a whopping 32% of people retire before 60. But only 6% of retirees actually continue working until 70, according to EBRI.

Here's why people are retiring earlier than they planned:

46% left work because of personal health issues.

43% retired early for employment reasons, like getting laid off or being burned out.

And 20% had to quit for family-related reasons, like having to take care of their parents or spouse.

Other factors to consider when choosing your retirement age:

You can't withdraw funds from your 401k until 59.5 without a 10% penalty.

Social Security retirement benefits start at 62 but increase each year you wait to file until age 70.

There are limits to how much income you can earn while collecting Social Security before your full retirement age.

Medicare coverage doesn't start until age 65.

Medicare uses your income from 2 years earlier to calculate your current monthly premiums.

Step 3: Enter your current income

Now, enter your current annual income. A rough estimate is okay.

The calculator will use this information to estimate your potential Social Security benefits.

It will also check to see if you are saving enough to reach your retirement income goals.

Most personal finance experts suggest saving at least 15% of your income for retirement.

Your current income is also a good benchmark for how much you'll spend each year in retirement.

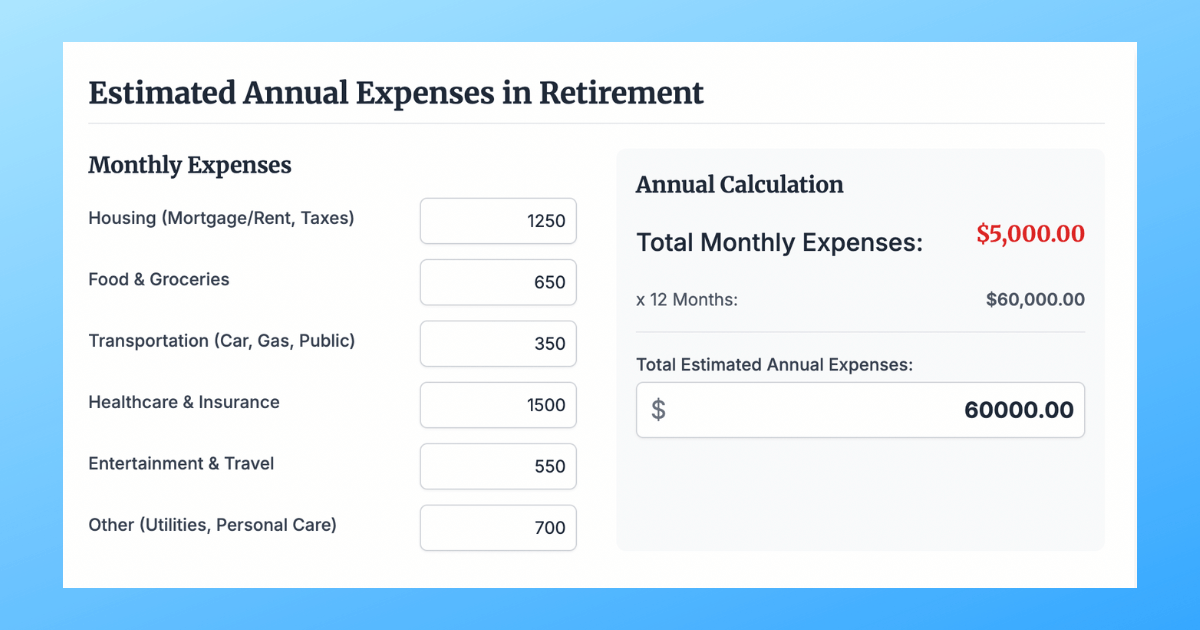

Step 4: Estimate your monthly expenses

Enter how much you think you'll spend each month in retirement to maintain your current lifestyle.

On average, retirees spend about 20% less than they did when they were working.

So, if you spend $10,000 per month to live your current lifestyle, it is unlikely you'll be able to survive on just a $3,000 per month Social Security check in retirement.

You can itemize your expenses by category or just enter a lump sum amount into one of the boxes.

Examples of monthly expenses to include:

Housing (Mortgage/rent, taxes, insurance)

Food and groceries

Transportation (Car payment, gas, insurance, maintenance)

Healthcare and insurance

Entertainment and travel

Other (Utilities, personal care)

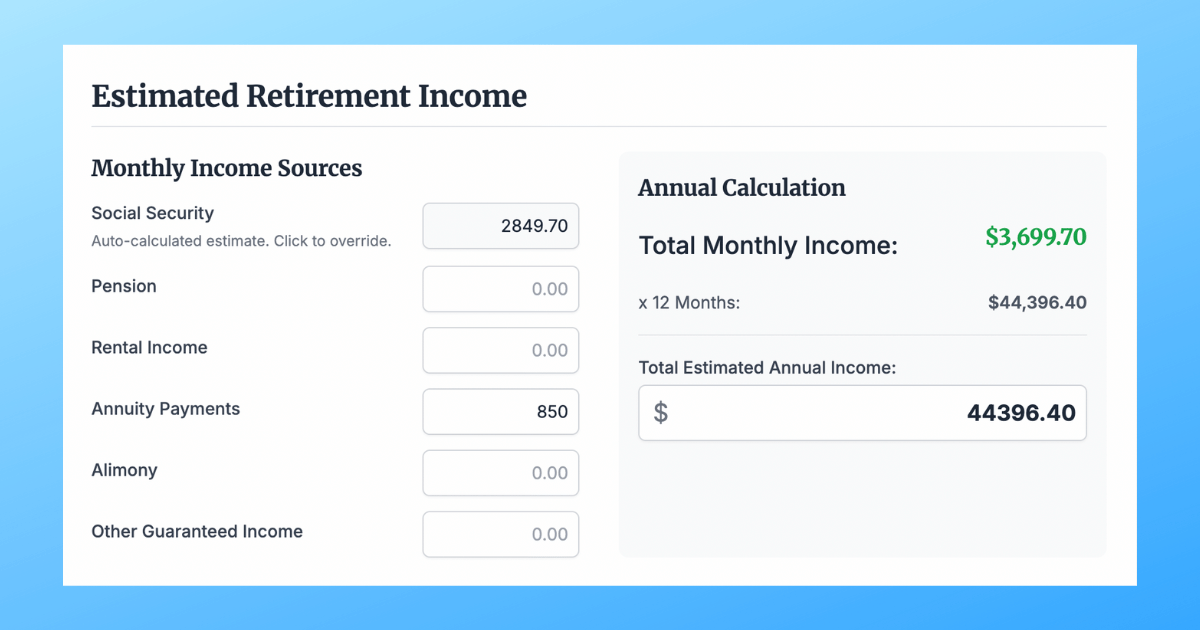

Step 5: Estimate your monthly retirement income

In this section estimate how much retirement income you anticipate earning.

This could include:

Social Security

Pension

Annuity payments

Rental income

Alimony

Other guaranteed income

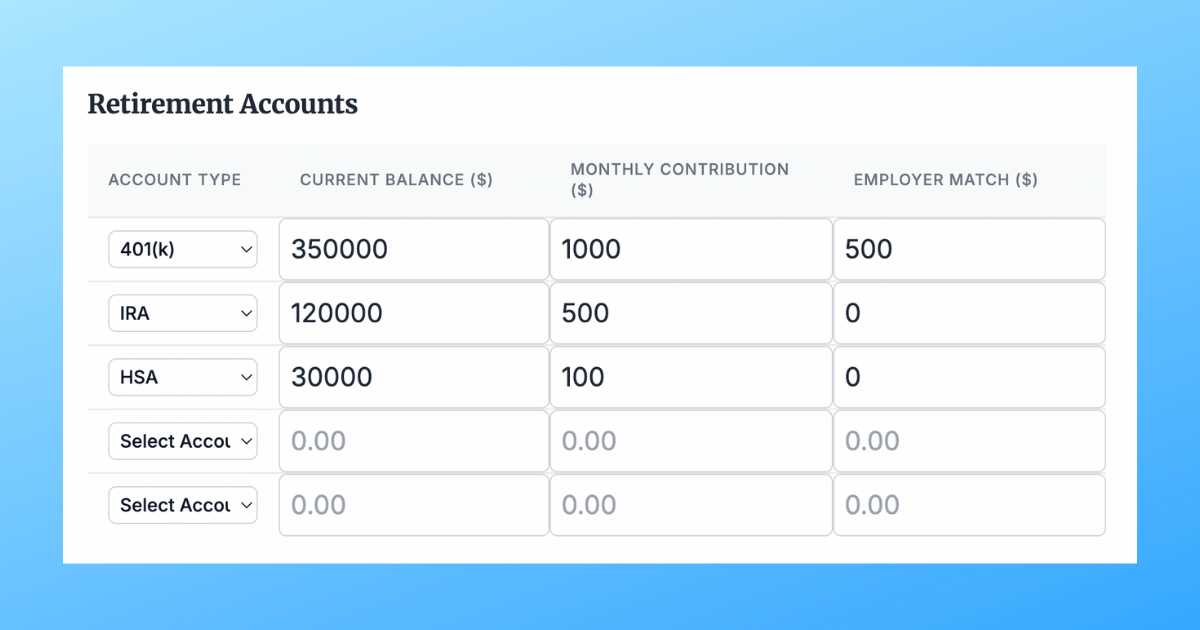

Step 6: Add up your retirement savings

Enter an estimate of your current retirement savings account balances. Include 401k, 403b, Roth or Traditional IRA, TSP, or HSA accounts.

(The calculator does not store your personal information. It is 100% secure and completely anonymous.)

This is the meat of your retirement plan. If your income sources are not enough to cover your monthly expenses, you'll need a way to convert your savings into additional income.

The calculator will find out how much you need to withdraw each month and how long your savings might last.

Also add any non-qualified brokerage accounts, too.

Step 7: Estimate the value of your assets

The final step is to add your cash and assets.

Estimate how much you have saved in your checking, savings, money market, CDs, fixed annuities, emergency fund, etc. You can enter one lump sum amount or break it down by category.

Next, enter the value of your primary residence, if you own. Include the value of any rental properties, too.

And if you own a business and you plan on selling in retirement, estimate the potential acquisition value.

Step 8: Click generate one page plan

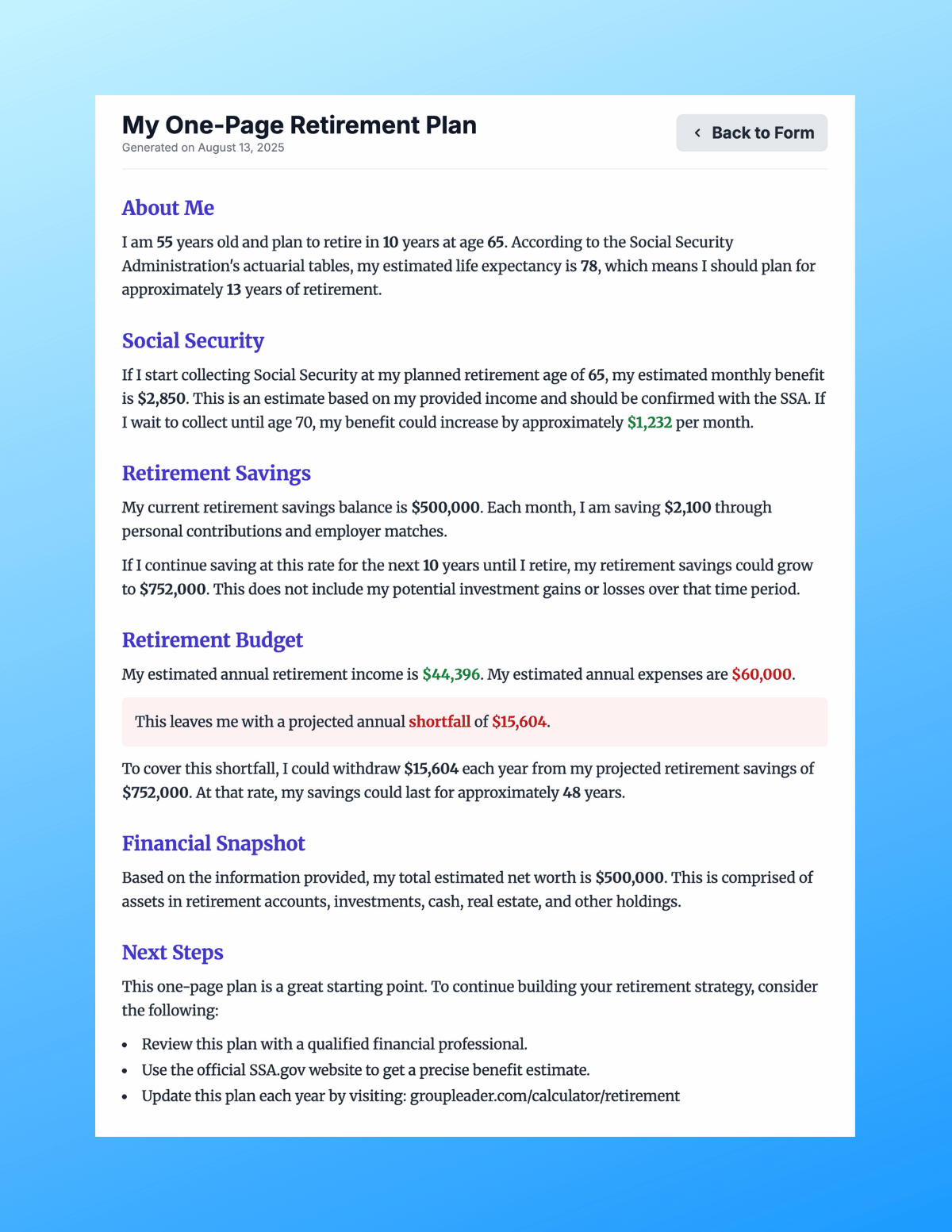

On the next page, you'll get a personalized retirement plan based on the numbers you entered.

Please note that this plan is not financial advice. It's just a summary of where you are now and where you plan to go.

It should give you a better idea whether you are on track to retire or not.

The coolest part of the report is that it is formatted in a way that is easy to read.

Instead of complex charts and graphs, it's a narrative about you.

Here's an example of what a one-page retirement plan looks like:

Step 9: Review your plan each year

The final step is to review your retirement plan at least once a year.

Change the numbers when your life changes. Keep it simple.

The best retirement plan is the one you actually use.

Start with this one-page version today. You can always add details later.

You don't need perfect numbers to start planning. Good enough beats perfect every time.

Banks hope you never discover this

Before you make any moves with your retirement savings, consider this:

Our team of retirement experts just revealed what they believe is the single most reliable strategy to protect savings and guarantee growth… and most retirees aren’t even aware it exists.

The method they recommend could protect your money from market crashes, inflation, and bad investment decisions.

It’s not complicated, it’s not risky, and it could completely change the way you think about retirement security. Click here to see the full step-by-step method.

How did you create your retirement plan? Share your tips in the comments.